Now that there is virtually no vacant land left in Dade and Broward what happens? What’s the you benefit when land value is greater than the income approach?

HIGHEST & BEST USE

Highest and best use is one of the most important and least understood principles in real estate. This principle, more than anything else is what

determines value for properties where the existing structure can be raised in something better developed in its place.

Why is the highest and best use so important? It is because the highest and best use determines the most profitable use of the site, whether the subject is vacant land or an improved property on the site, thus providing, in many cases the best net return to the landlord.

Want to know if your property's transaction zone (range of value) is greater when based is on it anticipated highest and best use, follow these guidelines:

- Is it legally permissible

- Is it physically possible

- Is it financially feasible

- Does it maximize profitability

Media Realty is an expert in answering those questions for our mid-core property owners to determine if the assets best defined by its land value or its income approach.

We 1st look at the property’s zoning to determine what could be built.

Based on the zoning, the size of the anticipated structure is estimated. For example, how many units if residential or square footage for commercial property.

The next step is to determine costs associated with the development project. These development costs include building costs, professional fees, marketing and sales costs, financing, contingency, entrepreneurial profit and other ancillary costs.

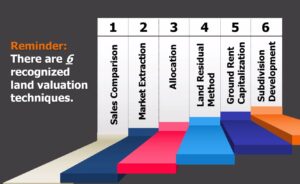

The last piece to the puzzle is land acquisition. This model is called the residual land value model and its most helpful to mid-core property owners to determine how best to achieve maximum return.

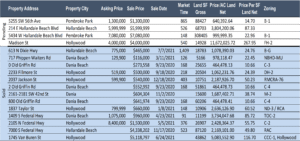

A search is then conducted to locate recent comparable land sales with similar size and zoning to extrapolate a price per square foot to be used as a check and balance against the residual land value. Click the below graph to view full report.

You may be surprised to find that you have a hidden asset on your property and its value may exceed your expectations.