Does the city of Hollywood rank among the best places for rental income in Florida? Let's find out!

As a broker who specializes in the South Florida Metro area, I have to argue that Hollywood is one of the best places for rental income in Florida. The surrounding towns of Oakland Park, Cooper City, Davie, and others are fabulous… but Hollywood has something special.

That being said, one of my firm's mottos is "make informed decisions" - so I'm going to use this article to back up the claim that Hollywood deserves a spot of the list of best places for rental income in Florida. Read on to find in-depth analysis and primary research of rental rates for Apartment dwellings of 10+ units (state land-use 03).

The research herein includes a sales grid with metrics for price-per-unit, price-per-square-foot, capitalization rates, gross rent multipliers, unit breakdown, and rent surveys.

If you’re looking for research in an area which is not included in any of these posts feel free to call me anytime to request research specific to your property and location.

How does Hollywood Weighs in Among the Best Places for Rental income in Florida...

(Costar Submarket Report)

The Hollywood Submarket has attracted a fair amount of apartment development over the past five years. One of the reasons that Hollywood ranks among the best places for rental income in Florida is that the submarket's lower than metro-average rents made the area popular with renters that want affordable alternatives to Downtown Fort Lauderdale or expensive premier suburban submarkets that lie to the west, such as Pembroke Pines or West Miramar.

Close to 1,000 units came to market over the past five years, increasing the submarket's inventory by 10%. Meanwhile, about 340 units are currently in the works. Due to the size of this submarket, vacancies spike when large projects deliver. But strong demand allowed vacancies to retreat towards their historical average before the coronavirus pandemic ensued in early March.

Consistent demand underscores Hollywood, Florida's position as one of the best places for rental income in Florida. Amid significant deliveries, relative to the size of this submarket, and on the back of the corona virus-driven rising economic uncertainty, the forecast is calling for vacancies to rise only mildly over the next year.

Sales volume for the submarket was healthy, before the coronavirus pandemic onset, totaling $97.6 million, compared to $150 million the prior year. Deal volume has subsided considerably since early March, a trend that is consistent with both the Fort Lauderdale metro and the country.

Investors are attracted to this submarket as pricing generally remained below the metro average over the past five years. Most deals over the past few quarters involved 2 and 3 Star buildings. As this submarket has grown over the past decade, it has consistently gained popularity with some national institutional investors, including JP Morgan Chase and Starwood Capital.

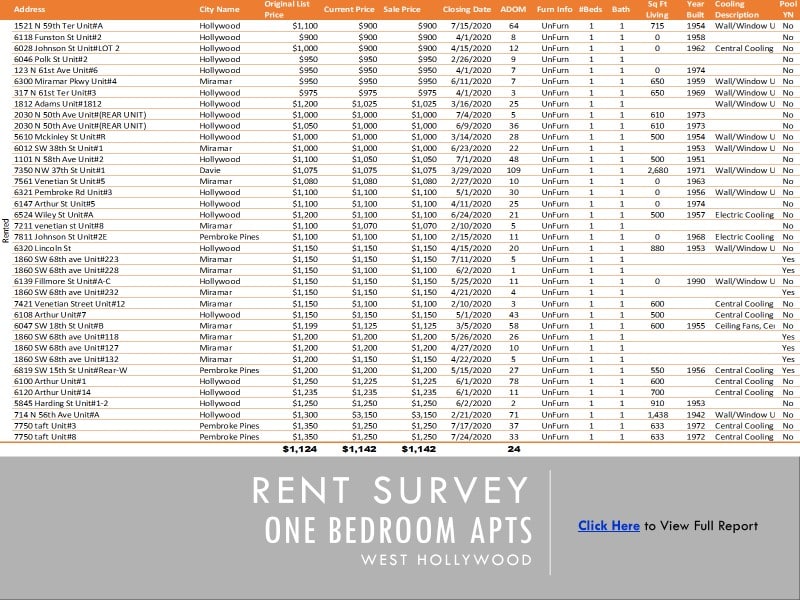

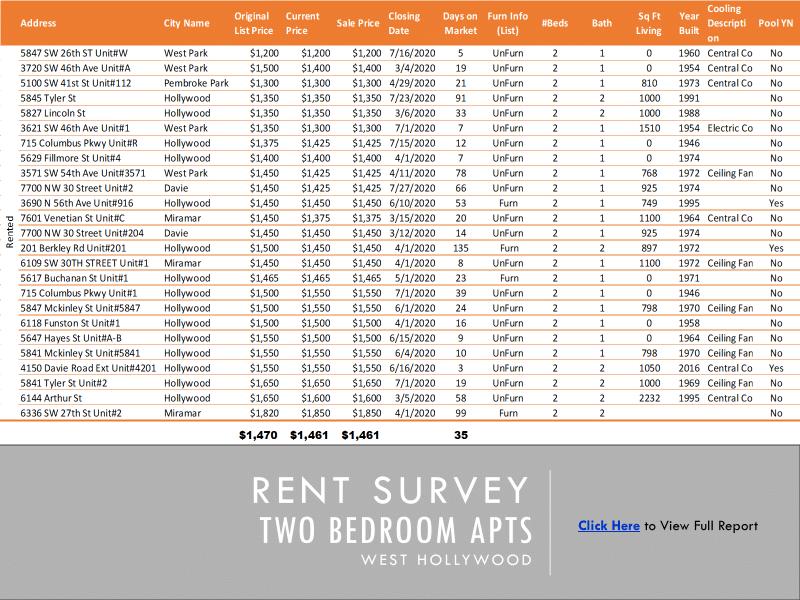

Rent Survey - West Hollywood Florida

The following are rent surveys for 1 and 2-bedroom apartments in West Hollywood. We invite you to utilize the rent surveys provided below in researching your investment property or a prospective purchase.

That being said, if you're considering selling or acquiring a residential investment property it's best to get the most up-to-date information to support your decision. In this case, please contact Peter Dacko for a complementary Proposal to Market. This Proposal to Market will include the most current rent surveys and other information complied specifically for your subject property. There's not obligation whatsoever, so let's work together to get you the most up-to-date information to support your next investment move.

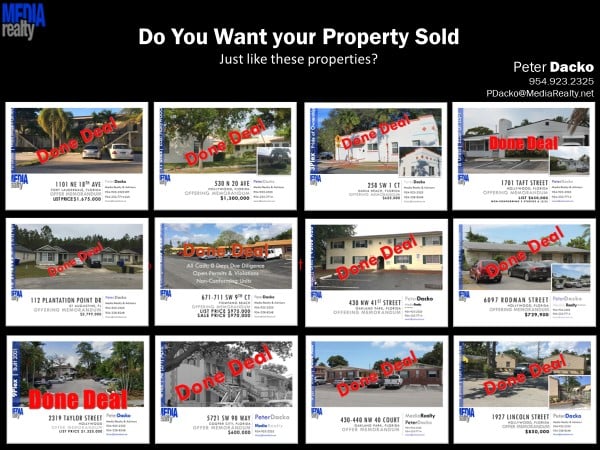

Comparable Sales - West Hollywood Multi-Family Investment Properties

The next document is a comparable sales sheet for multi-family apartment buildings in West Hollywood of 5 or more units.

What are Comparable Sales?

The market or direct sales comparison approach is a strategy to estimate the of value of a property. In this approach we undertake a process of comparing market data - that is, prices paid for similar properties, prices asked by owners, and offers made by prospective buyers or the tenants willing to buy or lease.

Typically a comparison grid is used and adjustments are made to each comparable sale used for major differences between the comparable and the subject property. These adjustments are made for factors like location, construction quality, and significant amenities. In this approach (the market/direct sales approach), the attempts are made to both gauge and reflect the anticipated reaction by a typical purchaser to the subject property.

Why Comparable Sales?

Taking the direct sales comparison approach can sometimes have beneficial outcomes for the estimated value of your property as compared to other appraisal strategies. As a broker, it's my job to establish the best value I can in any property I bring to market. That's why I spend the time to create comparable sales sheets and establish the value of my client's property.

Indeed, The selection of comparable sales is in most appraisals is the single most determining factor in establishing the value of the property. It is essential to fully research the local real estate market and determine which comparable sales represent the best value characteristics of the subject property.

CompsIf you're interested in receiving the most up-to-date rent surveys and comparable sales for your subject property, please contact me for a complementary Proposal to Market. My firm, Media Realty enables our clients to maximize their net returns by providing the best information. This allows our clients to make the most educated decision in a timely manner. Let us create value for you!