General market considerations for Purchasing Miami Dade, Palm Beach, or Broward county property.

In this post, we'll be exploring the South Florida Market at large, with a special emphasis on Broward County Property. Broward County is a specialty of mine, as I focus on "Middle Core" multi-family investment properties in Browed County. While I focus on commercial investment property, there are others who focus on family homes. For both types of property seekers, there's reason to investigate Broward County Property over properties in the neighboring county of Miami-Dade

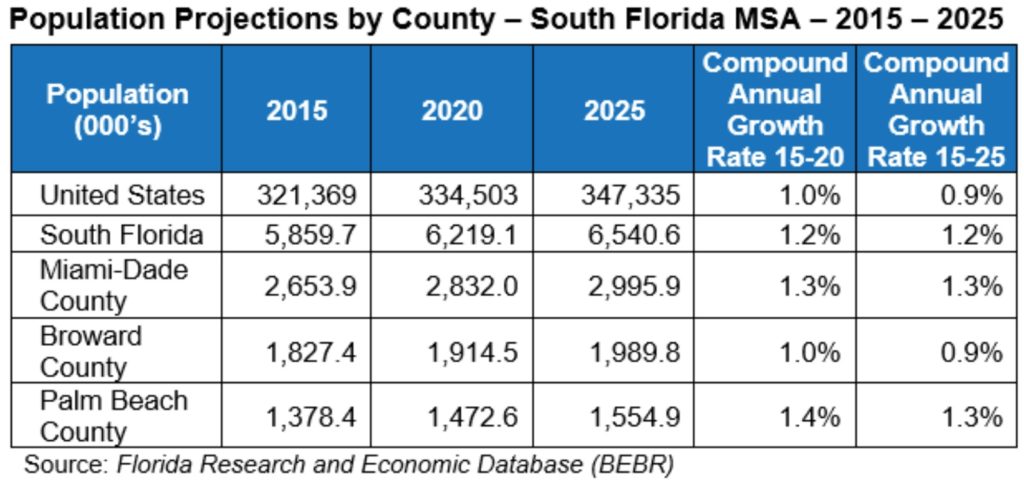

The Miami/Fort Lauderdale/West Palm Beach Metropolitan Statistical area comprises an area generally known as the south Florida region which includes Miami-Dade, Broward, and Palm Beach counties.

With over 6 million residents, the South Florida area is easily the most populous in Florida and the Southeastern United States. In fact, it is the 8th most populous area in the United States and is partially synonymous with the Gold Cost.

The South Florida metropolitan area consists of 3 distinct metropolitan areas, subdividing the region into it's three counties: Miami-Dade, Broward, and Palm Beach.

South Florida Population

- According to the 2018 U.S. Census Bureau estimation, Florida’s population is nearing 21.5 million during the past year and added more residents than every state but Texas. The most populous state remains California, with a population of 39.5 million, and the second most populous is Texas, with 28.9 million. The overall U.S. population is 328.2 million. Florida added 233,420 residents from July 1, 2018, to July 1, 2019. That ranked Florida second in number of new residents, as well as ninth in percentage gain, with a 1.10 percent year-over-year increase.

- With an estimated population of 21.5 million, the migration rate into Florida from other states and other countries was the highest in the country in the past year. More of Florida's population gain was the result of people moving into Florida, rather than babies born here. The relatively narrow difference between Florida's birth rate and death rate kept the state's overall population from growing even faster. This trend has increase as residents continue to emigrate from high-tax states like Illinois, New York and New Jersey.

During the past year, there was a net domestic migration of 132,612 people moving to Florida from other states and a net migration of 129,525 people moving to Florida from other countries.

South Florida Market - Considerations: South Florida and Broward County Property, Build Out, Employment, and Economy

- Prior to COVID-19 the South Florida economy was buoyed by strong job growth, a steady housing market, robust tourism, and increased construction activity. The South Florida’s economy was in full gear with minimal headwinds outside of the potential for short term economic damage from the COVID-19 related measures.

- South Florida accounted for than 54,000 jobs out of the 186,000 added statewide in 2018 than a year earlier. At the same time, unemployment is lower than it has been in over a decade, according to the state’s final monthly unemployment and job creation report for 2019. The jobs report for 2Q20 will likely be extraordinarily weak due to fallout from the COVID-19 related economic shutdown.

- Gross regional economic output was also increasing but may stumble for a few quarters before regaining its footing.

- The housing market has nearly fully recovered and is generally in equilibrium except for the Miami condo market, which is overbuilt.

- Those moving into the area are increasingly eyeing Broward county properties, as the county offers quieter beaches and lower population density than Miami and Palm Beach.

- Foreign Investment: Demand by foreign buyers and investors, mainly from South America, has slowed the Miami residential condominium market. Penthouse sales reflect the bulk of residential condo resale activity.

- Foreign investment from South America and Europe has slowed due to geopolitical unrest and a continued strong dollar, which in turn has slowed the Miami condominium market.

- Tourism: Cruise and air travel are up year-over-year, but after six years of increases, the hotel occupancy in the region has dropped slightly in the first half of 2019 mainly due to new supply. The South Florida hospitality industry will likely take a significant hit from the stoppage in passenger cruise lines and air travel.

- Infrastructure: Major transportation and infrastructure projects are planned or underway to improve the logistics of the region and, therefore, enable it to more effectively compete globally. Major improvements are underway at region airports and seaports. Passenger rail project, Brightline, opened the Fort Lauderdale–West Palm Beach segment in January 2018, followed by Fort Lauderdale–Miami in May 2018. An extension from West Palm Beach to Orlando via Cocoa is planned to open in late 2021 or early 2022, and more extensions are planned.

- Build-Out: One of the challenges for the South Florida metro area in general and Broward County property in particular is build-out. Broward County is the first County in the State to face the issue of build-out. Build-out occurs when available, vacant, or undeveloped land no longer exists. New development cannot occur without the demolishing, reconstructing, or subdividing of existing properties. As build-out becomes a reality, redevelopment within Broward County will be the future focus of how the County manages and directs growth, while protecting existing residential neighborhoods.

- Gambling: The Florida legislature has tabled the matter of expanded gambling in the State of Florida. The most recent bill proposed included two mega-casinos in South Florida.

- Population Age: The South Florida population is slightly younger than the state average but older than the national average. Palm Beach County is the oldest with a median age of 43.8 years. Miami-Dade and Broward Counties’ median ages are 38.8 years and 39.9 years, respectively. Florida has a median age of 38.7 years compared to the national average of 35.3 years.

- Income: According to the US Census Bureau South Florida's median household income tumbled more than 14% in five years, although the decline appears to be slowing. In 2011, the median household income fell to $48,880 in Broward County; $40,552 in Miami-Dade County; and $48,953 in Palm Beach County. The current median family income for Florida is $54,777. Real median family income peaked in 2007 at $63,084 and is now $8,307 (13.17%) lower.

- Poverty Level: The Census Bureau found that the number of South Floridians living below the poverty level has also increased over the past five years. Last year, 11.1% of Broward families and 11.6% of Palm Beach County families were in poverty. Approximately 15.6% of Miami-Dade residents live below the poverty level versus 15.6% for overall Florida.

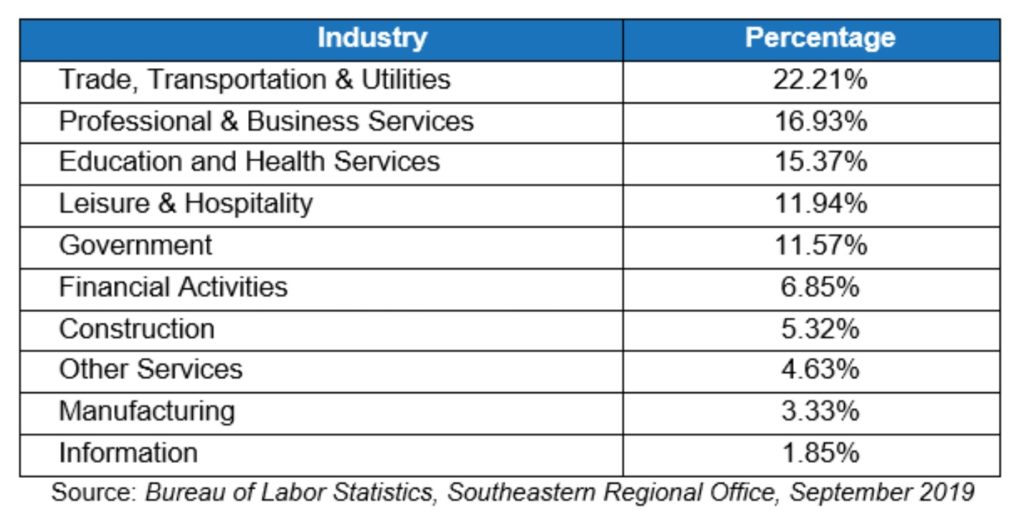

South Florida Employment

With nearly 2.73 million in the labor force, South Florida represents nearly one-third of the total labor force in the State of Florida, which is primarily a service-based economy. The number can balloon during peak tourism times due to seasonal staffing. Service jobs represent more than 38% of non-agricultural employment. Trade is the most important industry in South Florida followed by tourism. Employment distribution in the Miami MSA is presented on the accompanying table.

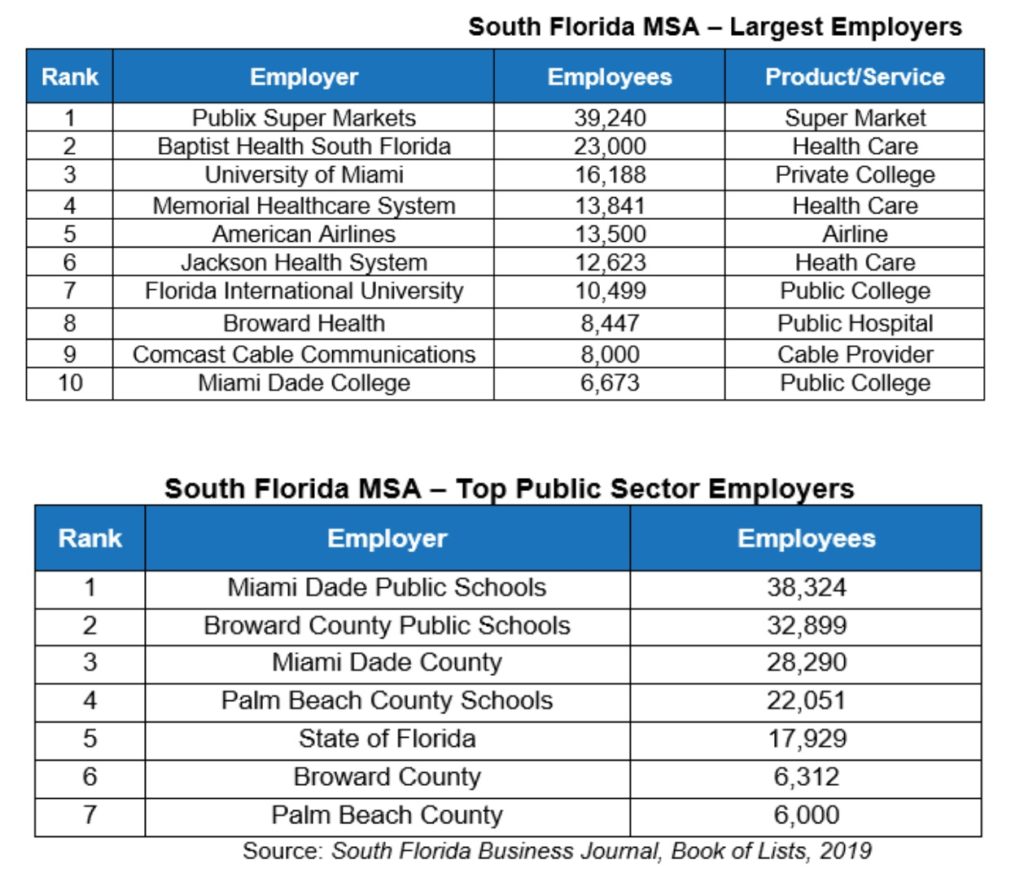

Major Employers in the South Florida Area

The Miami Area MSA is home to nine Fortune 500 companies – World Fuel Services (83), Publix Supermarkets (91), AutoNation (145), Lennar (154), NextEra Energy (184), Office Depot (285), Rockwell Collins (350), Ryder System (363), and MasTec (436) and a number of Fortune 1000 companies. The region’s employers include national and international corporations that encompass a variety of industries including retail, biotechnology, and healthcare.